GM frens! Welcome to the first installment of WIP, a decentralized public ledger tracking crypto’s hottest news, controlled solely by me – some Twitter anon.

“But wait,” you object. “How can your newsletter be decentralized if you’re the only one in charge?”

I suggest you redirect your complaint to Binance – the centralized exchange that single-handedly froze its so-called decentralized blockchain last week. If they get to call their network “decentralized,” then certainly so do I!

That’s our top story for this Monday’s letter, alongside some price news and a Kim Kardashian SEC drama splash. Let’s dive in!

(FYI: This ain't some perma-bull hopium blog. Whether you’re a dot eth NFT whale or contrarian crypto skeptic, we’re here to tell it like it is in this industry. Come to laugh or be sorely disappointed.)

BNB Chain Hacked for $500 Million+

So a major DeFi hack occurred against the Binance bridge on Thursday, fraudulently draining it of 2 million BNB. That’s worth $558 million at current prices.

For non-crypto nerds, a “bridge” is an official reserve where cryptocurrency is stored when transferring assets to another blockchain besides BNB Chain. In other words, this bridge held all of the BNB and other assets that were “wrapped” onto other chains.

As a researcher at Paradigm later explained, the attacker managed to forge proofs required to withdraw assets from the bridge. Using these proofs, he minted 1,000,000 new BNB in two separate transactions. “The damage could have been far worse,” added the researcher.

Whoever the attacker was, he hurriedly dispersed the funds across multiple other blockchains, which can make them more difficult to track or seize.

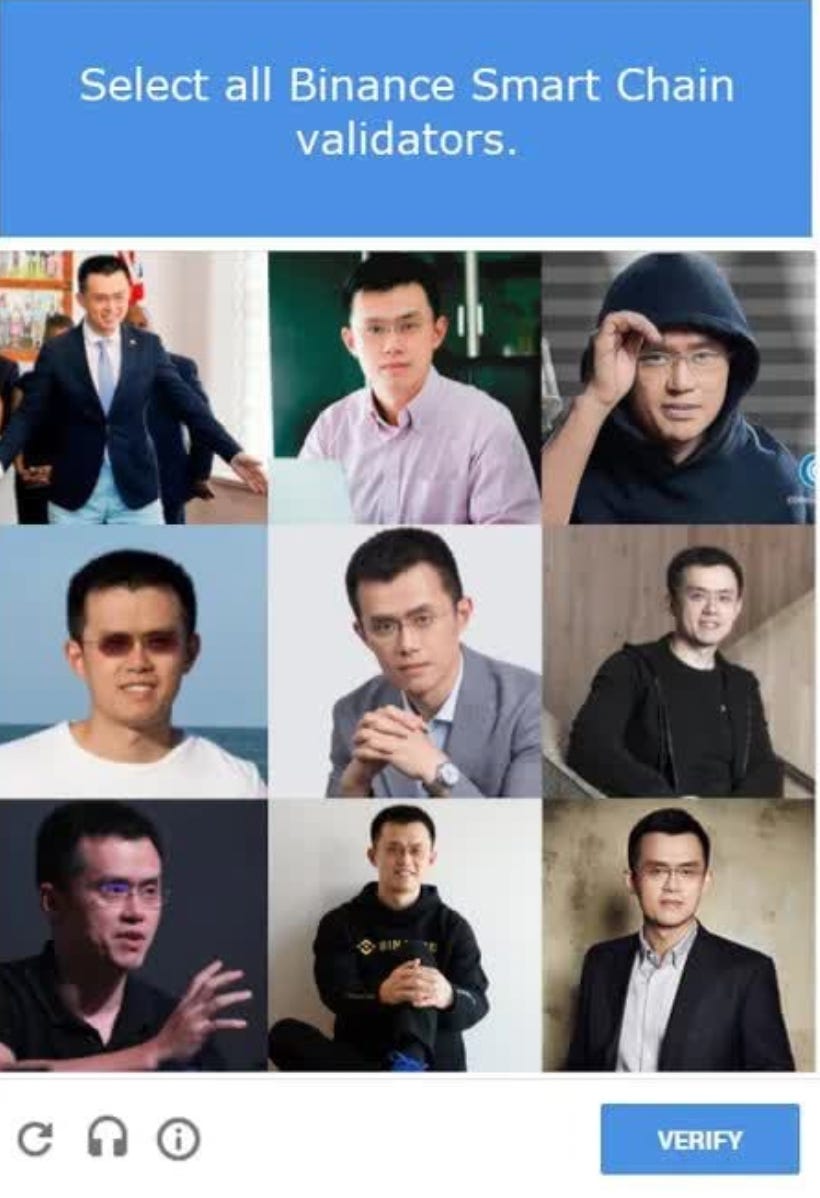

With little time remaining and a $500 million hole in their blockchain, Binance took decisive measures: It called on all validators to freeze the blockchain, preventing the attacker – and everybody else – from moving their funds for some time.

The chain has since come back online, but not before critics could point out the irony of the situation. “You're supposed to be immutable fren,” said the Bitcoin smart contract platform, Stacks, about the situation.

A reminder that Binance’s guide on BNB Chain promises that the network will be “forever decentralized.” Well, if they say it’s decentralized, then it must be so!

Uptober Hype Die Fast

Bitcoin pumped past $20,000 last week on Uptober hype but fell back into range around $19,000 by the following Monday.

“Uptober” is a crypto meme centered around the fact that digital assets have historically performed well in October, following typically bearish September.

Ethereum also remained stuck around $1300, while no other major cryptos made significant moves – besides XRP, which has been pumping on favorable news from Ripple’s legal dispute with the SEC.

Kim Kardashian Found Guilty of Shitcoining

Ever heard of EthereumMax? Yeah, neither had anyone – until Kim Kardashian decided to post on Instagram about it.

The guys behind the token paid the celebrity $250,000 to promote the token while advertising its decision to implement a burn. Translation: “Number goes up, buy our coin.”

However, Kim K didn’t disclose that the advertisement was paid promotion, which is a no-no for the Securities and Exchange Commission (SEC). They forced her to pay $260,000 in disgorgement for her actions, plus another $1,000,000 in penalties.

“Ms. Kardashian’s case also serves as a reminder to celebrities and others that the law requires them to disclose to the public when and how much they are paid to promote investing in securities," said SEC chair Gary Gensler on the situation.

As always, our friend Gary is valiantly protecting investors from the most dangerous market participants, which certainly include Kim Kardashian.

Fed Doubles Down on War With Inflation

No, the Fed isn’t reversing course yet, as much as crypto bulls would like to believe it.

Fed governor Philip Jefferson said on Tuesday that his central bank colleagues are committed to “taking the further steps necessary” to deal with rising inflation. That likely means more rate hikes and more pain for markets – including the crypto market.

To be fair, even the rest of the world is surprised that the Fed is taking things so far. The United Nations issued a warning to central banks on Monday that continued monetary tightening could spark a sovereign debt crisis across the developing world.

We know the Fed was late in responding to inflation. The question is, will they be late to fight back against recession as well?

Elon Musk is Buying Twitter (For Real This Time)

Tesla CEO Elon Musk’s acquisition deal with Twitter has been revived for the originally agreed price of $54.20 per share – or $44 billion in total.

Your guess is as good as mine as to why he’s flip-flopping again. He tried to buy the company in April as some kind of free speech hero, then tried to back out in July because of something about spam bot data, but who knows what the man is actually thinking?

Either way, the crypto people seem pretty happy about the revival. In fact, some message logs surfaced in September of Musk speaking with various Bitcoin/ crypto higher-ups about decentralizing the platform before the acquisition deal was first proposed.